Unlock Your Financial Future: The Role of Financial Literacy

Financial literacy is the cornerstone of improved financial health, empowering individuals to make informed decisions about budgeting, saving, investing, and debt management, ultimately leading to greater financial security and well-being.

Do you ever feel lost in the sea of financial jargon and complex investment options? Understanding the role of financial literacy in improving your overall financial health is the first step towards taking control of your finances and building a secure future. Let’s dive in and explore how you can boost your financial well-being through knowledge and informed decision-making.

Understanding Financial Literacy

Financial literacy is more than just knowing how to balance a checkbook. It’s about possessing the skills and knowledge necessary to make informed and effective decisions with all of your financial resources.

A solid understanding of financial concepts can empower you to achieve your financial goals, whether it’s buying a home, saving for retirement, or simply managing your day-to-day expenses more effectively.

Key Components of Financial Literacy

Financial literacy encompasses several essential areas. Let’s explore some of the key components that build a strong foundation for financial well-being.

- Budgeting and Saving: Creating a budget and sticking to it is fundamental to financial health.

- Debt Management: Understanding how to manage and minimize debt is crucial, including credit cards, loans, and mortgages.

- Investing: Learning about different investment options and strategies to grow your money over time.

- Financial Planning: Developing a long-term financial plan that aligns with your goals and priorities.

In conclusion, financial literacy is a multifaceted skill that involves understanding, managing, and planning your financial resources to achieve your goals.

The Impact of Financial Literacy on Budgeting

Budgeting is a cornerstone of financial health, and financial literacy plays a pivotal role in creating and adhering to an effective budget.

When you’re financially literate, you can identify your income sources, track your expenses, and allocate your funds in a way that aligns with your financial goals.

Creating a Realistic Budget

Creating a realistic budget involves more than just listing income and expenses. It requires an understanding of your spending habits and financial priorities.

Take the time to review your financial statements, track your spending, and identify areas where you can cut back. Websites and apps can help track expenses but its important to set limits and check those expenses. When you are more savvy about your expenses this makes for better predictions for future budgets.

Tracking Your Expenses

- Use Budgeting Apps: Many apps can help you track your spending and categorize your expenses.

- Review Bank Statements: Regularly review your bank statements to identify any unusual or unnecessary expenses.

- Set Financial Goals: Define your financial goals to stay motivated and focused on your budget.

Ultimately, financial literacy empowers you to create and maintain a realistic budget that aligns with your goals, leading to better financial management.

How Financial Literacy Helps with Debt Management

Debt management is a critical aspect of financial health, and financial literacy provides the tools to handle debt effectively.

Understanding interest rates, loan terms, and repayment options can help you make informed decisions about borrowing and managing debt.

Strategies for Managing Debt

Financial literacy helps you develop effective strategies for managing debt, such as prioritizing high-interest debt and exploring debt consolidation options.

Here are some strategies for managing debt and taking control of your own economy through better decision making.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first.

- Debt Consolidation: Consider consolidating your debts into a single loan with a lower interest rate.

- Create a Repayment Plan: Develop a realistic repayment plan that fits your budget and allows you to pay down your debt over time.

In conclusion, financial literacy is essential for effective debt management, enabling you to make informed decisions and develop strategies to reduce debt and improve your financial well-being.

Investing Wisely with Financial Literacy

Investing is a powerful tool for building wealth, but it’s important to approach it with knowledge and understanding. Financial literacy can help you make informed investment decisions and avoid costly mistakes.

Understanding risk tolerance, investment options, and market trends can help you create a diversified portfolio that aligns with your financial goals.

Understanding Investment Options

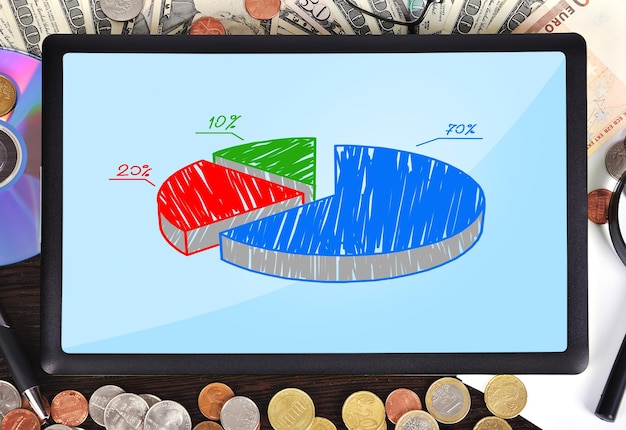

Financial literacy helps you understand the different investment options available, such as stocks, bonds, mutual funds, and real estate.

A diversified portfolio manages investments and spreads them properly. There are a plethora of options depending on how you want your money to grow.

Assessing Risk Tolerance

- Evaluate Your Comfort Level: Determine how much risk you’re comfortable taking with your investments.

- Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk.

- Seek Professional Advice: Consider consulting a financial advisor for personalized investment advice.

To summarize, financial literacy is crucial for making wise investment decisions, enabling you to understand risk, diversify your portfolio, and pursue your long-term financial goals.

Financial Planning and Long-Term Financial Health

Financial planning involves setting long-term financial goals and creating a roadmap to achieve them. Financial literacy is essential for developing a comprehensive financial plan that aligns with your values and priorities.

When you understand financial concepts and principles, you can make informed decisions about retirement planning, insurance coverage, and estate planning.

Setting Financial Goals

Setting clear and achievable financial goals is the first step in developing a long-term financial plan. These would include deciding when you want to retire, when you plan to purchase a major thing (like a car or a house), etc.

Define your goals, prioritize them, and create a timeline for achieving them. Having goals in the short, mid and long term can help you plan out your financial future.

Planning for Retirement

- Estimate Your Retirement Needs: Determine how much money you’ll need to cover your expenses in retirement.

- Explore Retirement Savings Options: Consider retirement savings options such as 401(k)s, IRAs, and Social Security.

- Seek Professional Guidance: Work with a financial advisor to develop a retirement plan that meets your specific needs.

In conclusion, financial literacy is foundational for long-term financial health, enabling you to set financial goals, plan for retirement, and make informed decisions about insurance and estate planning.

Resources for Improving Financial Literacy

Improving your financial literacy is an ongoing process. There is always something to learn or improve upon.

Fortunately, there are many resources available to help you expand your knowledge and skills.

Books and Websites

There are countless books and websites dedicated to financial literacy. Look at options such as Forbes, NerdWallet and more. These websites are there to help educate you on potential financial decisions.

Seek out reputable sources that provide clear and unbiased information.

Financial Courses and Workshops

- Take Online Courses: Many online platforms offer courses on personal finance topics.

- Attend Workshops: Look for workshops in your community that cover budgeting, investing, and other financial topics.

- Consult a Financial Advisor: Consider working with a financial advisor who can provide personalized guidance and support.

In summary, there are numerous resources available for improving your financial literacy, including books, websites, courses, and workshops. Take advantage of these opportunities to expand your knowledge and take control of your financial future.

| Key Point | Brief Description |

|---|---|

| 💰 Budgeting | Track income and expenses to make sound choices. |

| 📈 Investing | Learn about options, manage risk, and diversify assets. |

| 💸 Debt Management | Prioritize high-interest debt and create repayment plans. |

| 🎯 Financial Planning | Set clear goals and make long-term plans. |

Frequently Asked Questions

▼

Financial literacy is the ability to understand and effectively use various financial skills, including budgeting, saving, debt management, and investing. It’s essential for making informed financial decisions.

▼

It empowers you to make well-informed decisions about your money, leading to improved financial stability, reduced debt, and the ability to achieve your financial goals, such as buying a home or retiring comfortably.

▼

You can improve your financial literacy by reading books on personal finance, taking online courses, attending financial workshops, following financial experts, and regularly reviewing your own financial situation. Many free resources are available.

▼

Common mistakes include overspending, not budgeting, ignoring debt, failing to save for retirement, and making impulsive investment decisions. Financial literacy helps you identify and avoid these pitfalls, leading to better outcomes.

▼

It’s never too early or too late to start learning about financial literacy. The sooner you begin, the better equipped you’ll be to make sound financial decisions throughout your life. Start today!

Conclusion

In conclusion, financial literacy is an essential life skill that empowers individuals to take control of their financial futures. By understanding the principles of budgeting, debt management, investing, and financial planning, you can make informed decisions that lead to greater financial security and well-being.