HUD 2026: 90-Day Rental Assistance Application Window Unveiled

In 2026, HUD programs introduce a critical 90-day application window for rental assistance, aiming to streamline access and provide more efficient support for eligible individuals and families seeking affordable housing solutions across the United States.

DOE 2026 Initiatives: Boosting K-12 Outcomes by 10%

The New Department of Education Initiatives for 2026 aims to significantly improve K-12 outcomes by 10% through strategic investments in personalized learning, teacher development, and robust community partnerships.

Social Security 2026: 3.2% COLA Impact Explained

The 3.2% Cost-of-Living Adjustment (COLA) for Social Security in 2026 will directly increase beneficiaries' payments, aiming to help maintain purchasing power against inflation, significantly impacting financial planning for millions of Americans.

Energy Efficiency Tax Credits 2026: Claim Up to $3,200 for Home Improvements

Homeowners in the United States can significantly reduce their tax liability by claiming up to $3,200 in energy efficiency tax credits for eligible home improvements made in 2026, fostering sustainable living and substantial savings.

Federal Unemployment Benefits 2026: The 26-Week Standard Explained

In 2026, understanding the 26-week standard for federal unemployment benefits is crucial for job seekers, as it defines the duration of financial support available while transitioning between employment.

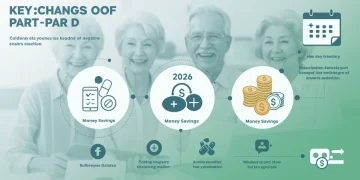

Medicare Part D 2026: Reduce Prescription Costs by 25%

The 2026 changes to Medicare Part D are set to significantly impact beneficiaries, offering new avenues to reduce out-of-pocket prescription drug costs by up to 25% through revised caps and enhanced subsidies.

Maximize Your 2026 HSA: New Federal Contribution Limits of $4,150

The 2026 Health Savings Account (HSA) contribution limits have been updated to $4,150, providing a significant opportunity for eligible individuals to save more for healthcare expenses with triple tax advantages.

VA Benefits 2026: Housing & Education Changes

In 2026, significant updates to Veterans Affairs housing and education benefits are set to impact veterans across the United States, introducing crucial adjustments to eligibility, funding, and application processes for vital support programs.

SBIR Grants 2026: Secure Up to $250,000 for Your Innovation

Small Business Innovation Research (SBIR) Grants 2026 offer a vital pathway for U.S. small businesses to secure federal funding, providing up to $250,000 in non-dilutive capital for research and development of high-potential innovations.

2026 Farm Bill: Subsidies, Conservation, and Key Provisions

The 2026 Farm Bill is poised to significantly reshape U.S. agricultural policy, focusing on four key provisions that will influence everything from farm subsidies and crop insurance to vital conservation programs and rural development initiatives.